The Research: 650+ sources analyzed. 200+ companies examined. Every major AI platform evaluated. Months of analysis condensed into actionable insights.

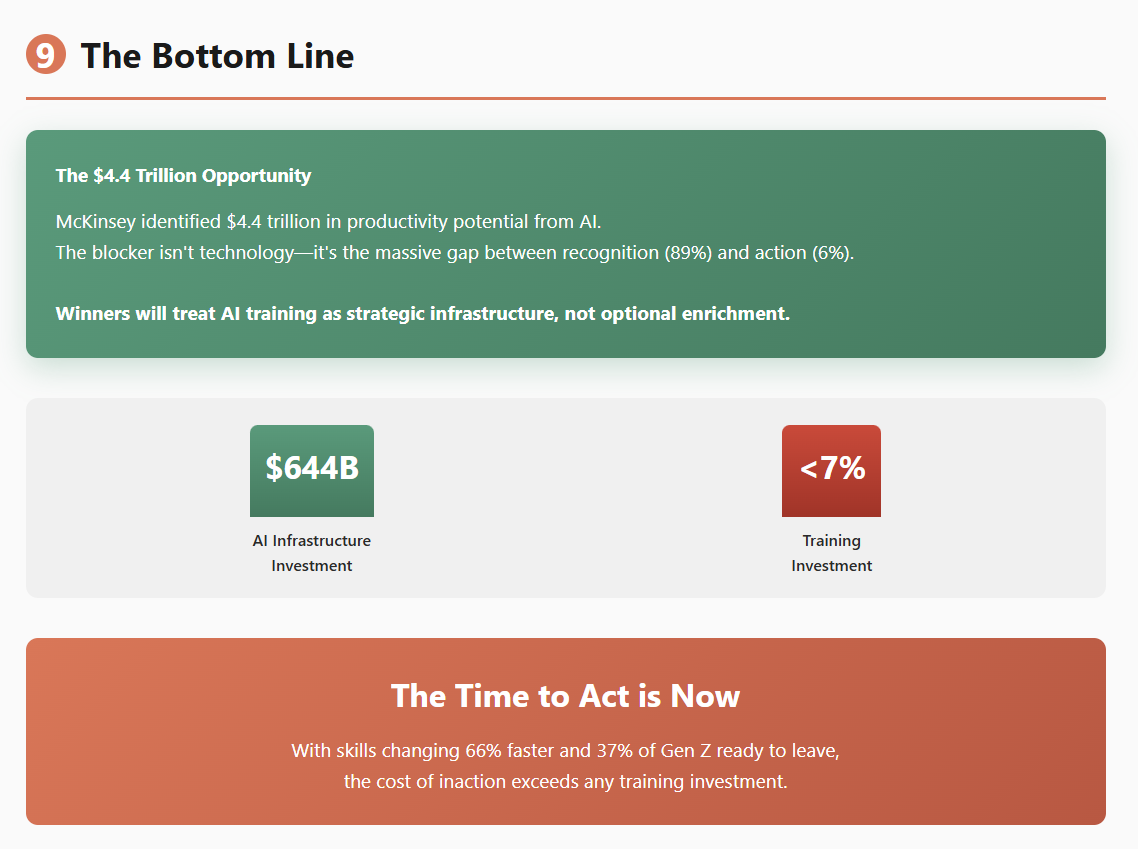

The Finding: Enterprises are spending $644 billion on AI in 2025, but 80% see no material earnings impact. The blocker isn’t technology—it’s the massive gap between who needs training (89%) and who’s actually doing it meaningfully (6%).

Why This Matters: Companies with proper AI training show 234% ROI. Without it, 80% fail. The difference? Understanding what skills actually matter, how much they cost, and how to build them at scale.

Report Sections:

Section 1: The Training Crisis Quantified

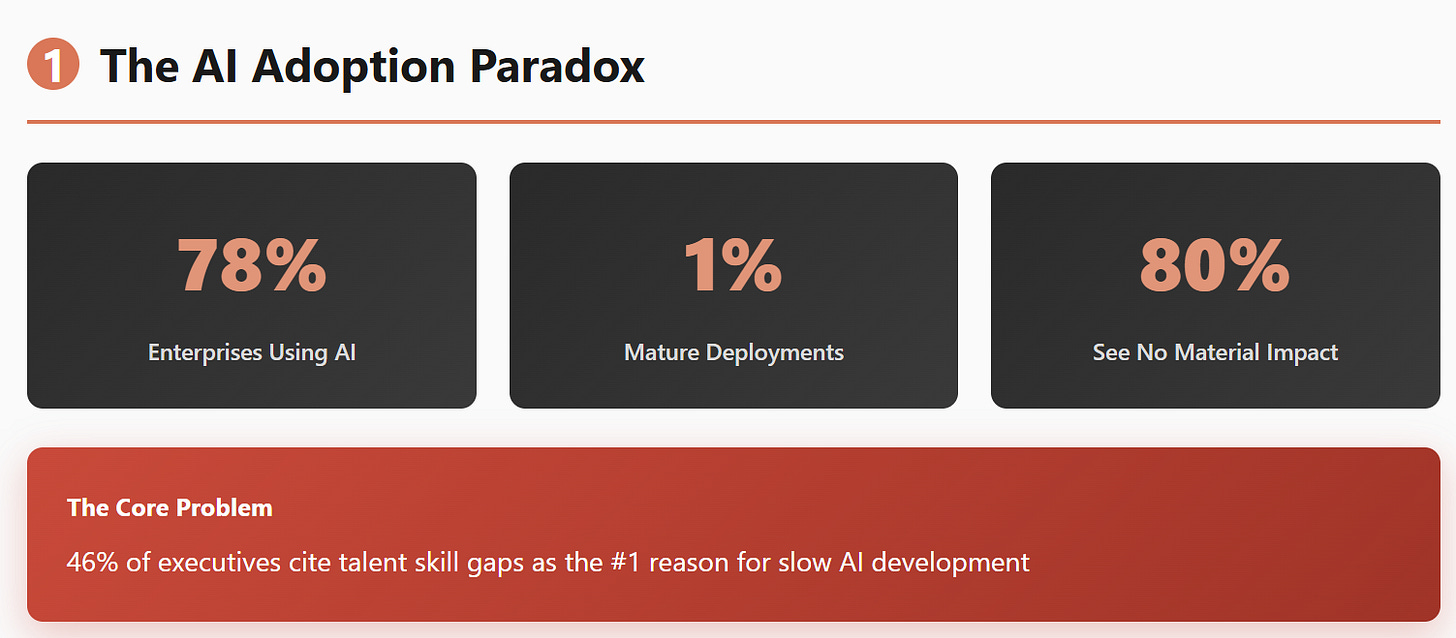

Hard data on the 78% adoption vs. 1% maturity paradox

The 46% citing skills as their #1 barrier

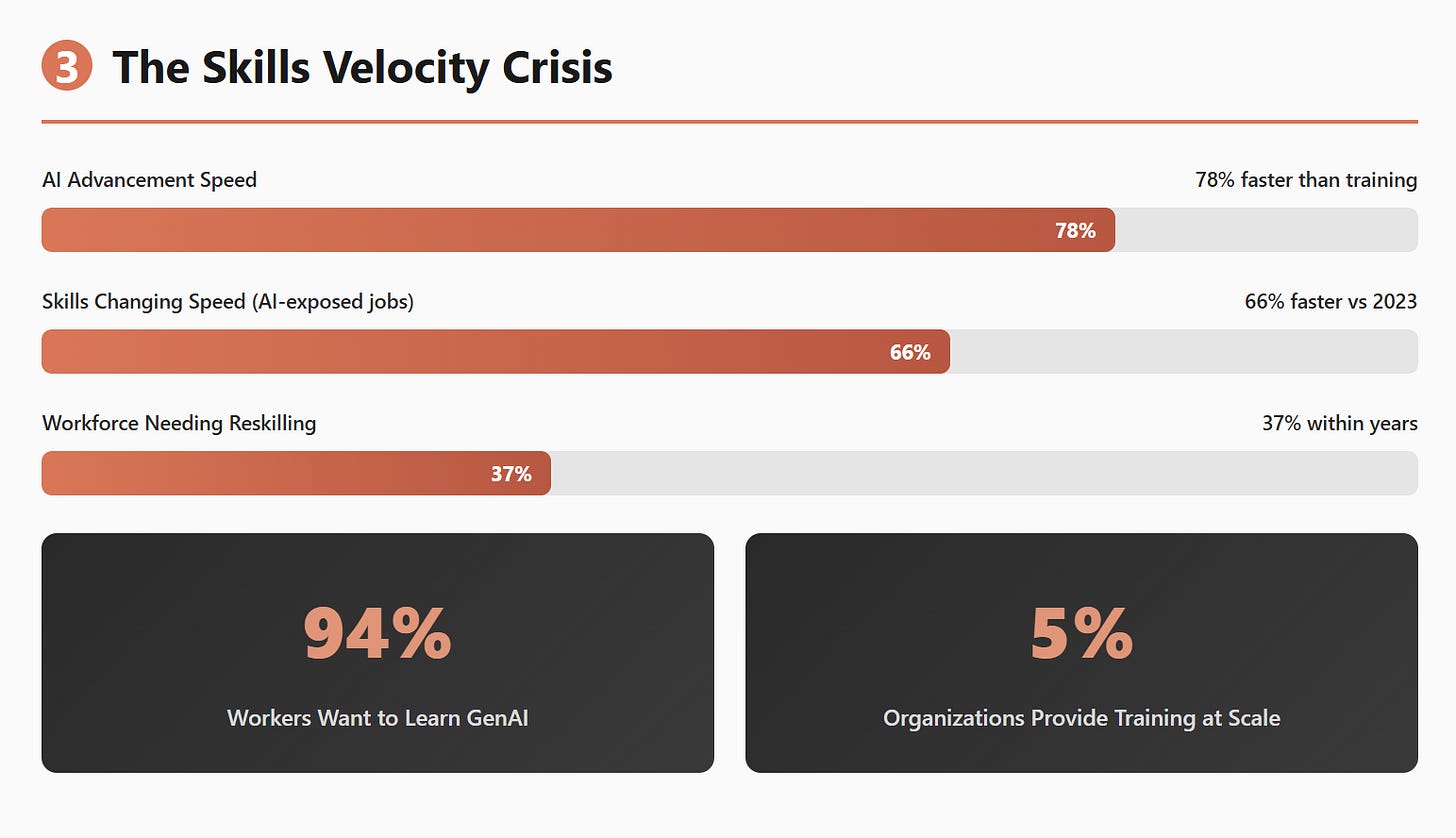

Why skills are changing 66% faster than training can keep pace

Financial impact: $4.4 trillion productivity opportunity at stake

Section 2: The Seven Critical Pain Points

From talent shortage (62% of C-suite) to ROI uncertainty (51%)

Why one-size-fits-all training fails (Moderna case study)

The speed mismatch creating constant obsolescence

Cost uncertainty paralyzing decision-makers

Section 3: What Leaders Actually Say

Direct quotes from Nadella, Benioff, Franklin (Moderna), Sweet (Accenture)

Internal perspectives on what’s working and failing

The cultural prerequisites nobody talks about

Section 4: Enterprise AI Spending Reality

Average: $62,964/month, jumping to $85,521 in 2025

Individual company deep dives: Accenture’s $3B, AWS’s 234% ROI

The wage premium explosion: 56% for AI skills (up from 25%)

Section 5: Skills That Actually Matter

Beyond prompt engineering: Agent orchestration, MLOps, cost intelligence

Role emergence: AI compliance specialists, ethics officers

Technical vs. cognitive skills breakdown

Why 40% report critical thinking shortages

Section 6: Training Solutions Market Analysis

100+ providers evaluated and categorized

Platform comparison: Features, pricing, effectiveness

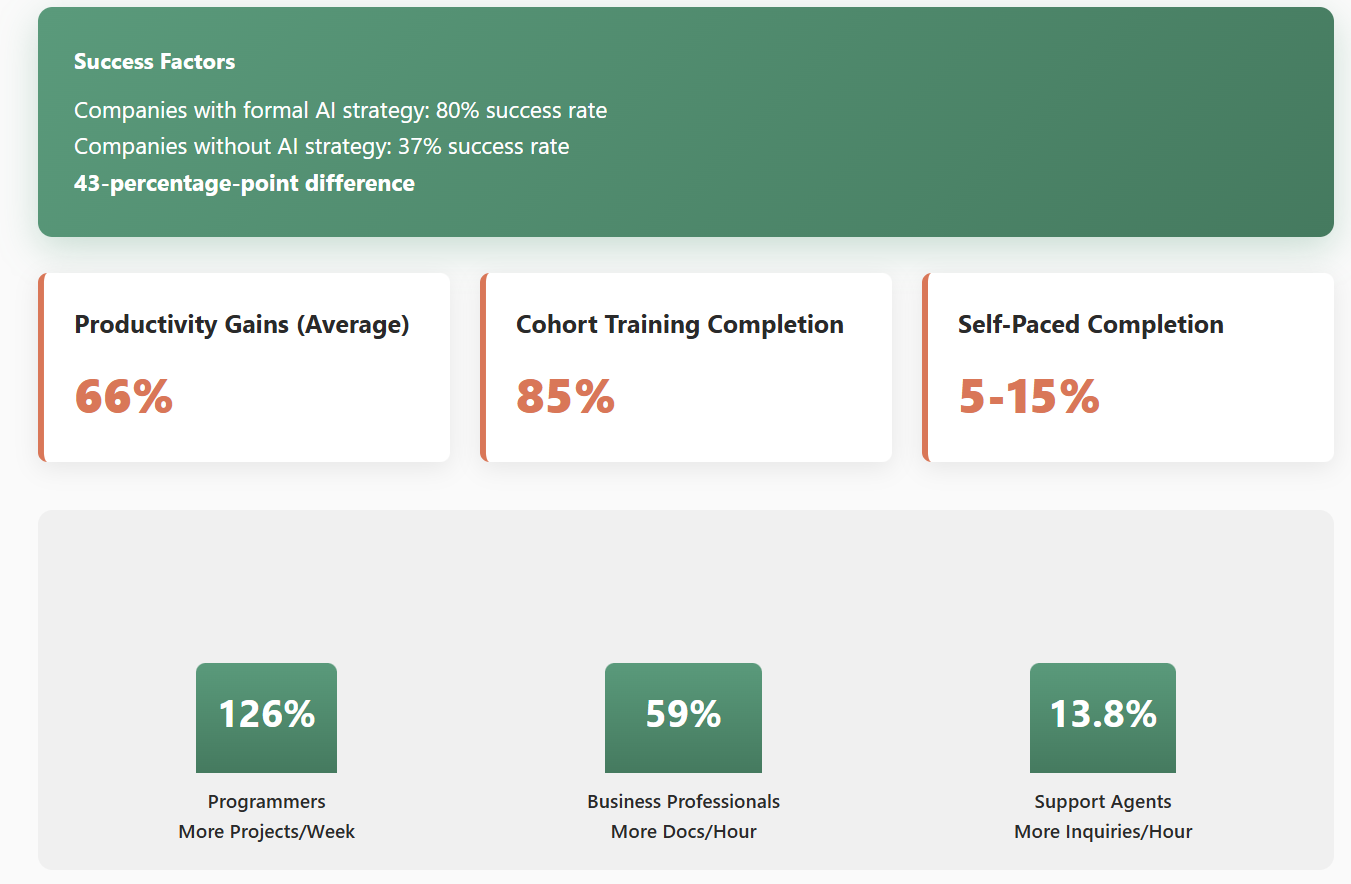

Cohort-based (85% completion) vs. self-paced (5-15%)

Enterprise platforms vs. bootcamps vs. MOOCs

Section 7: Agent-Building Capabilities

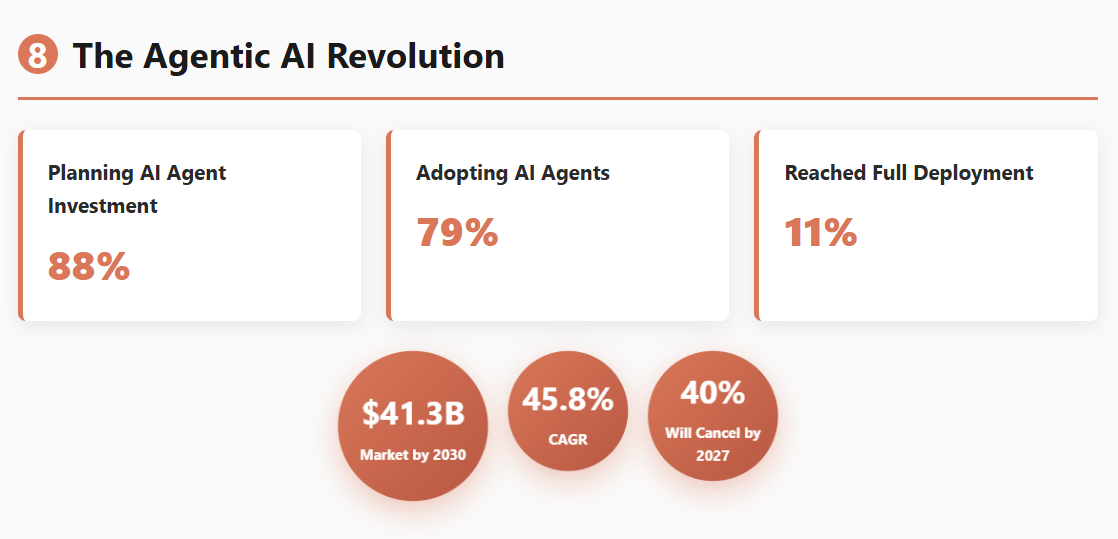

Why this is the next frontier (88% planning investment)

Framework comparison: LangChain, AutoGen, Agentforce

Technical skills required beyond basic prompting

Real implementation costs: $100K+ annually per agent

Section 8: ROI Data and Case Studies

66% average productivity increase (Nielsen Norman)

Specific wins: Qualcomm (2,400 hours/month saved)

What correlates with success vs. failure

The 43-point gap between strategy and no strategy

Section 9: Segment-Specific Recommendations

Fortune 500 with dedicated teams

Mid-market building capabilities

SMBs without AI specialists

Detailed roadmaps for each segment

What You’ll Know After Reading:

Exactly which skills your organization needs (not vendor hype)

Real costs of training programs ($5K-$1M+ range)

Which platforms and providers deliver ROI

How to avoid the failures hitting 80% of enterprises

Specific implementation roadmaps by company size

Who This Is For:

C-suite executives allocating AI budgets

HR leaders designing training programs

Consultants advising on AI transformation

IT leaders selecting platforms and tools

Anyone responsible for AI ROI

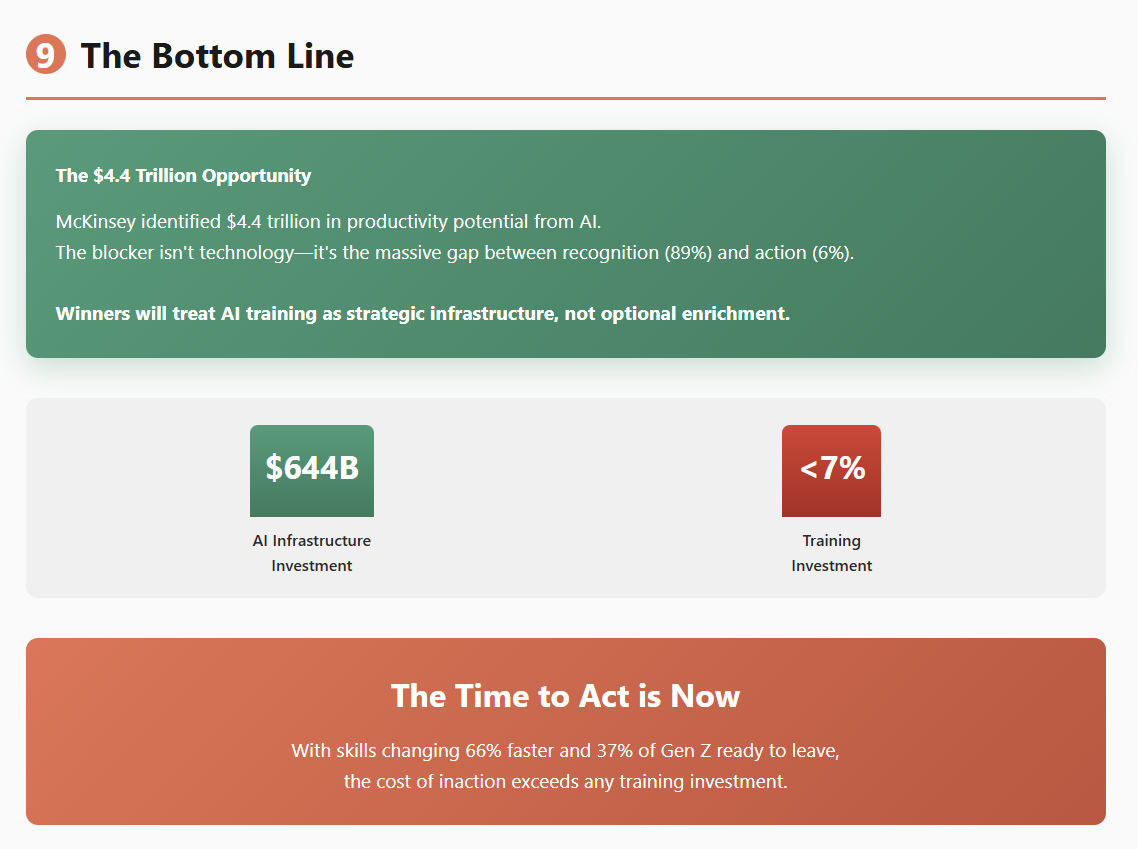

The Bottom Line: This report bridges the gap between AI investment and AI returns with data, not opinions.

The paradox is stark: 78% of enterprises now use AI, yet only 1% report mature deployments and 80% see no material earnings impact.

The culprit isn’t technology—46% of executives cite talent skill gaps as the #1 reason for slow AI development. While companies plan to spend $644 billion on GenAI in 2025, only 6% have begun meaningful upskilling despite 89% acknowledging critical workforce gaps.

This report reveals the specific training needs, spending patterns, and solutions enterprises require to capture AI’s productivity potential—from Fortune 500 companies like KPMG with dedicated AI teams to smaller businesses navigating AI without specialists.

The training crisis is worsening faster than solutions emerge

AI is advancing 78% faster than corporate training programs can keep pace, according to Accenture’s 2024 research.

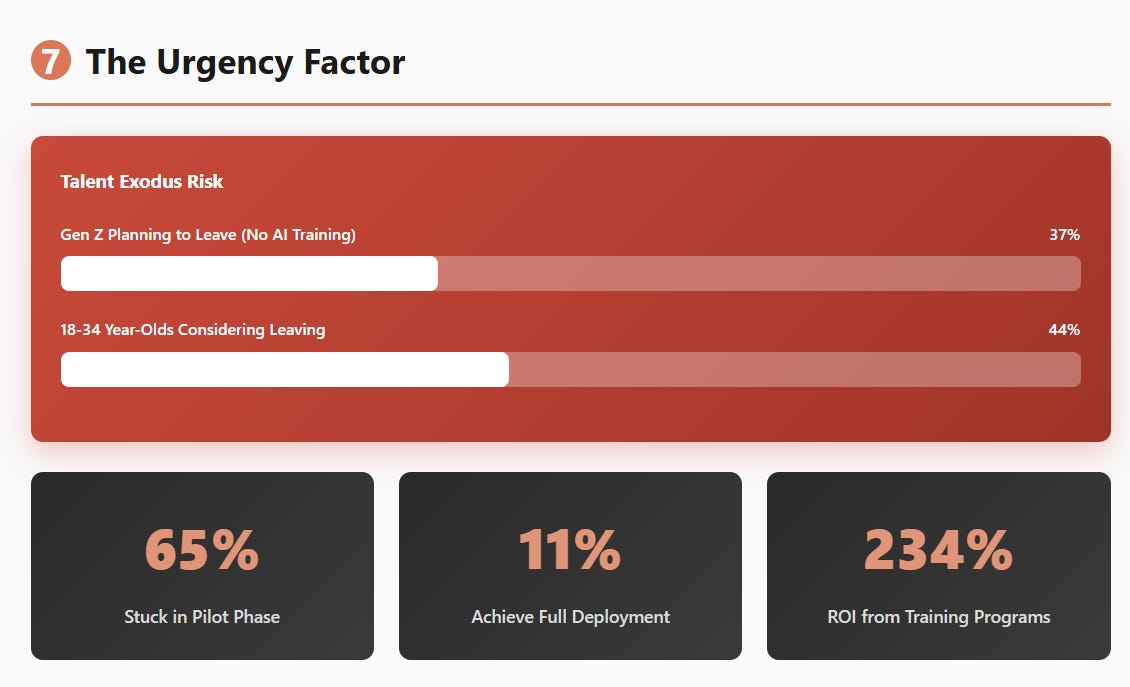

This creates a dangerous spiral: 94% of workers want to learn generative AI skills, but only 5% of organizations provide training at scale.

The consequence? Enterprises are stuck in pilot purgatory—65% have AI pilots but only 11% achieve full deployment. Meanwhile, 47% of employees believe they’ll use AI for 30%+ of daily work within a year, but only 20% of leaders expect this level of adoption, revealing a massive perception gap between workforce readiness and leadership understanding.

The skills velocity problem is unprecedented.

PwC reports skills are changing 66% faster in AI-exposed jobs compared to 2023, with 37% of the workforce requiring reskilling within years due to GenAI. Yet training infrastructure remains woefully inadequate: only 22% of employees receive organizational AI support in the U.S., compared to 84% internationally.

This isn’t just about technical skills—40% of executives report shortages in critical thinking and problem structuring, the higher-order cognitive abilities that AI augmentation requires.

Seven critical pain points block enterprise AI education

The talent shortage dominates everything else. McKinsey’s survey identifies the talent skills gap as the #1 barrier (46%), followed by resourcing constraints (38%).

But the challenge extends beyond hiring: 62% of C-suite executives in a BCG study cite shortage of talent and skills as their biggest challenge, ahead of unclear investment priorities (47%) and lack of responsible AI strategy (42%).

The most telling statistic: only 6% of organizations that acknowledge needing better AI skills have actually begun upskilling “in a meaningful way.”

One-size-fits-all training fails spectacularly.

Moderna’s CHRO Tracey Franklin discovered their universal AI awareness program “worked in certain circumstances and didn’t in others”—some employees found courses too basic while others found them too complex.

This points to a fundamental design flaw in early enterprise AI training: treating a data scientist, marketing manager, and customer support representative as needing the same foundational knowledge.

Modern AI training requires role-specific pathways that recognize vastly different technical depth needs across functions.

The speed mismatch creates constant obsolescence.

When 78% of executives say AI is advancing too fast for training efforts, and 49% of employees report training isn’t keeping pace with AI advancement, organizations face a treadmill problem.

By the time a 12-week bootcamp concludes, the tools and best practices have evolved.

This demands shift from one-time training events to continuous learning infrastructure that updates as rapidly as the technology itself.

Leadership misalignment undermines execution.

Despite workforce readiness, only 48% of C-suite leaders would involve non-technical employees in early AI development stages.

McKinsey concludes bluntly: “employees are ready for AI; the biggest barrier to success is leadership.” This manifests in inadequate budget allocation, unclear priorities, and lack of executive sponsorship.

Companies with formal AI strategies show an 80% success rate versus 37% without—a 43-percentage-point gap that highlights leadership’s critical role.

Cost uncertainty paralyzes decision-making.

Only 51% of organizations can confidently evaluate AI ROI, and less than 30% of AI leaders report their CEOs are happy with returns despite average spending of $1.9 million on GenAI initiatives in 2024.

This creates a vicious cycle: without clear ROI frameworks, companies can’t justify training investments; without trained employees, they can’t achieve the adoption rates needed to demonstrate ROI.

Time constraints and change resistance compound the problem. Skillsoft’s 2024 survey found employees “struggle to find time or leadership support for completing programs.”

Meanwhile, 47% cite workforce resistance to change as a major obstacle to agentic AI deployment, alongside technical skills gaps (59%) and system complexity (39%).

The Randstad survey reveals troubling demographic divides: only 22% of baby boomers have AI expertise versus 62% of millennials (35-44), suggesting generational change management challenges.

The scale of transformation overwhelms organizations.

Executives estimate an average 32% of their workforce needs retraining, with the World Economic Forum predicting 40% of core skills will change for workers.

In automotive, 36% of the workforce needs retraining; in financial services, 28%. Yet 82% of early-stage companies haven’t applied a talent reinvention strategy or acquired new training for AI-led workflows.

The gap between what’s needed and what’s being executed represents one of the largest organizational transformation challenges in modern business history.

What enterprise leaders actually say about the skills crisis

Tracey Franklin, CHRO at Moderna,

offers unvarnished advice on AI transformation:

“Don’t be incremental. I would go all in and really set the stage culturally that this is where the organization is moving.”

She warns against leading with cost savings—”that doesn’t excite any employee”—and emphasizes the failure of universal training approaches.

The most interesting shift:

requiring AI fundamentals for all staff initially, then pivoting to role-specific training after discovering the one-size-fits-all approach didn’t work across her organization’s diverse workforce.

Julie Sweet, Chair and CEO of Accenture,

frames the urgency around becoming “talent creators” rather than just talent consumers:

“We are passionate about helping our clients become ‘talent creators’—with people at the center of their reinvention using technology, data and AI—and a critical part of that is investing in industry-specific training and technology skills development.”

Her $1 billion investment in LearnVantage and acquisition of Udacity signals Accenture’s belief that training infrastructure itself is a strategic differentiator.

Sweet emphasizes that “companies that build a strong foundation of AI by adopting and scaling it now, where the technology is mature and delivers clear value, will be better positioned to reinvent, compete and achieve new levels of performance.”

Dave Williams, Executive VP and Chief Information Officer at Merck,

connects AI training directly to the pharmaceutical company’s core mission:

“To continue delivering on our promise to use the power of leading-edge science to save and improve lives around the world, we are developing and investing in our people. We have launched a groundbreaking generative AI training program for our employees in partnership with Accenture to create world-class digital leaders.”

This framing—AI training as enabler of life-saving innovation—shows how enterprises link upskilling to strategic outcomes beyond efficiency gains.

Marc Benioff at Salesforce

describes AI as providing a “digital workforce” where humans and automated agents work together.

His prediction at Dreamforce 2024—”more than a billion agents running from Salesforce within the next 12 months”—implies massive training needs for employees to manage, direct, and collaborate with AI agents.

72% of Fortune 500 CHROs foresee AI replacing jobs in the next three years, according to Gallup’s survey, intensifying the urgency around reskilling programs that position employees as AI orchestrators rather than victims of automation.

Satya Nadella at Microsoft emphasizes the cultural prerequisite:

“Although this new era promises great opportunity, it demands even greater responsibility from companies like ours.”

His call for organizations to evolve from “know-it-alls” to “learn-it-alls” captures the mindset shift required.

At Ignite 2024, Nadella stressed managing “unintended consequences” proactively—a reminder that AI training must include governance, ethics, and risk management, not just technical proficiency.

Enterprise AI spending explodes while training lags behind

Organizations increased AI infrastructure spending by 97% year-over-year in H1 2024, reaching $47.4 billion and projected to surpass $200 billion by 2028 according to IDC.

Enterprise LLM budgets alone grew 75% over expectations from the prior year, with one CIO noting:

“What I spent in 2023 I now spend in a week.”

Yet this massive investment concentrates on technology, not people—innovation budgets for AI dropped from 25% to just 7% of spending as AI moves from experimental budgets to centralized IT and business unit funding.

The numbers reveal dramatic scale differences.

Accenture invests over $1 billion annually on training and learning across its 700,000+ employees, delivering 40 million training hours annually.

Their $3 billion investment over three years in their Data & AI practice (announced June 2023) and $1 billion in LearnVantage (March 2024) demonstrates Fortune 500-level commitment. They’ve trained 550,000 employees in generative AI basics and expanded from 40,000 to 77,000 AI data experts.

67% of enterprises plan to spend $50-$250 million on GenAI in the next year according to KPMG data—budgets that dwarf most companies’ entire training allocations.

For context on individual AI spending: the average organization spends $62,964 per month on AI in 2024, projected to jump 36% to $85,521 monthly in 2025 per CloudZero’s survey of 500 software engineers.

45% of organizations plan to invest over $100,000 per month in AI tools in 2025, up from just 20% in 2024. Currently 37% spend more than $250,000 annually on LLMs alone, with 73% spending over $50,000 annually on AI infrastructure.

In retail and consumer products, IBM’s study shows executives plan to allocate an average 3.32% of revenue to AI—translating to $33.2 million annually for a $1 billion company, with spending outside traditional IT operations surging by 52% over the next year.

Financial services accounts for over 20% of all enterprise AI spending, making it the heaviest-investing sector.

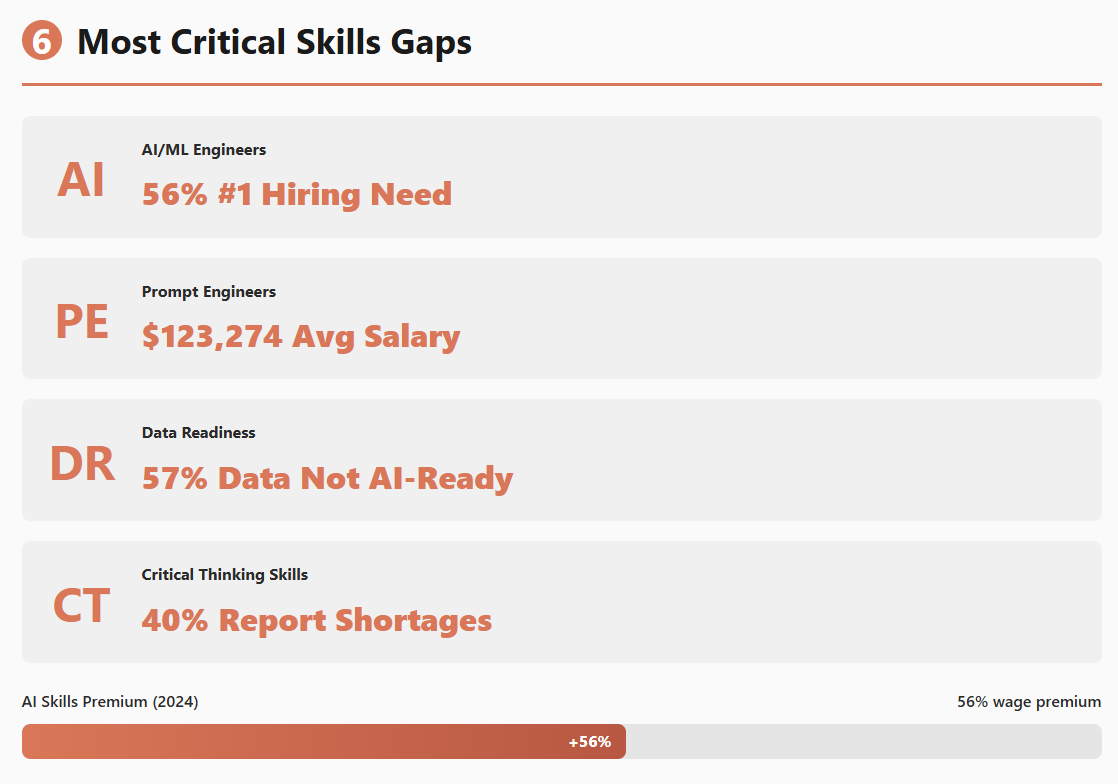

The wage premium for AI skills compounds the investment equation. AI-skilled workers command a 56% wage premium in 2024, more than double the 25% premium from the previous year according to PwC’s Global AI Jobs Barometer.

Prompt engineers earn $123,274 average base salary, with top positions at companies like Anthropic reaching $335,000.

AWS certification holders see employers paying 43-47% more for AI-skilled workers, with Forrester documenting 234% ROI from AWS training and certification programs.

These skills are most urgently needed across enterprises

AI/ML engineers dominate demand, with 56% of software engineering leaders rating this as their #1 hiring need for 2024 according to Gartner. But the skills shortage extends far beyond engineering roles.

Prompt engineering has emerged as a critical capability with salaries ranging $110,000-$250,000 at Big Tech and $100-$300/hour for freelance specialists. Job listings emphasize instruction crafting, iterative testing, and ethics/safety monitoring—skills that didn’t exist as formal disciplines two years ago.

Data readiness remains the fundamental blocker: 57% of organizations estimate their data isn’t AI-ready, creating desperate need for data science and advanced analytics capabilities.

This explains why machine learning operations (MLOps) has become foundational—enterprises need to standardize, scale, and augment AI initiatives with end-to-end governance and lifecycle management.

Gartner predicts 80% of the engineering workforce must upskill through 2027 to maintain relevance.

Emerging specialized roles show the sophistication gap. 13% of organizations have hired AI compliance specialists and 6% have hired AI ethics specialists, according to 2024 surveys.

These roles didn’t exist in most organizations three years ago.

The demand reflects enterprises moving from experimentation to production, where governance, bias detection, and regulatory compliance become non-negotiable.

Beyond technical skills, 40% of executives report shortages in critical thinking and problem structuring—the higher-order cognitive abilities that determine how effectively humans direct AI systems. This shortage matters more than many realize: AI doesn’t replace strategic thinking; it amplifies it. Leaders need to ask better questions, structure ambiguous problems, and evaluate AI-generated outputs for accuracy and relevance.

Companies also face shortages in creativity, complex information processing, leadership, change management, and teaching skills needed to upskill workforces at scale.

The skills change velocity is accelerating.

PwC reports skills are changing 66% faster in AI-exposed jobs compared to 2023. IBM surveys indicate 31% of employees need to learn new skills within the next year, and 45% within three years.

Formal degree requirements are declining for AI roles—jobs AI augments requiring degrees fell 7 percentage points (66% to 59%) between 2019-2024, while jobs AI automates requiring degrees fell 9 percentage points (53% to 44%). Emphasis is shifting toward practical skills, certifications, and hands-on experience over traditional educational credentials.

The AI training solutions market is exploding with options

Enterprise AI learning platforms offer comprehensive infrastructure for scaled training programs. Sana Learn positions as an AI-native platform (not retrofitted) that saves up to 15 hours per course creation and delivers Core licensing at $13/user (300 minimum) or custom Enterprise pricing. They report Polestar achieved a 275% increase in active users after implementation.

360Learning takes a collaborative approach, positioning SMEs as “content superheroes” with AI-powered authoring that reduces content development time by 50%, starting at $8/registered user/month.

Docebo provides AI LMS for large-scale programs with Deep Search AI, auto-tagging, skill-tagging, and social learning, reporting 32% higher completion rates.

EdApp focuses on mobile-first microlearning for frontline workforces, with AI Create reducing development time by 65% and achieving 42% knowledge retention improvement. CYPHER Learning’s Copilot AI generates courses with assessments in 50+ languages, with Spryker reporting 10x content creation efficiency.

These platforms typically charge $8-30/user/month, with enterprise custom pricing available.

Tech companies provide certification pathways that validate technical expertise. AWS launched the AWS Certified AI Practitioner in 2024, expanding their AI certification portfolio that includes Machine Learning Engineer and Data Engineer credentials.

AWS Skill Builder offers 600+ free digital courses, with paid exams ranging $100-$300.

Microsoft’s Azure AI Fundamentals and Azure AI Engineer Associate certifications integrate with their Cloud & AI Bootcamp launched in 2024-2025 as a major enterprise training initiative.

Google Cloud offers Professional Machine Learning Engineer and Data Engineer certifications at $99-$200 per exam, with 87% of certified users reporting increased confidence and 25%+ taking on leadership roles.

NVIDIA’s Deep Learning Institute provides GPU-accelerated computing expertise essential for building AI applications.

Consulting firms bring strategic transformation expertise.

Accenture LearnVantage (launched March 2024) represents a $1 billion investment over three years, acquiring Udacity to bring Nanodegree programs in-house.

Their AI-native learning platform serves Fortune 500, government, and mid-market enterprises with personalized learning at scale. Deloitte’s AI Academy and $3 billion commitment to AI capabilities focuses on bridging technical skills with business know-how, particularly for regulated industries.

PwC, EY, and KPMG each offer AI consulting and implementation services with emphasis on operational AI, assurance, and trust frameworks.

McKinsey provides strategic AI consulting with their “Superagency in the workplace” framework, while BCG partners with Anthropic for responsible AI implementation, focusing on ethical deployment at Fortune 500 scale.

Specialized AI bootcamps deliver intensive upskilling.

BrainStation offers 13-week full-time and part-time bootcamps in AI, ML, and data science, having worked with 500+ instructors from innovative brands.

DataCamp provides self-paced Machine Learning Engineer tracks for teams. Microsoft’s Cloud & AI Bootcamp delivers free virtual and on-demand training curated by experts. SymphonyAI runs industry-specific bootcamps for retail and CPG companies with hands-on AI training led by domain experts.

These programs typically span 12-38 weeks depending on intensity, with custom corporate pricing.

AI-specific training startups are emerging rapidly.

Edstellar provides instructor-led AI training globally with Skill Matrix tools for gap analysis. Correlation One focuses on data literacy and AI-driven skills with measurable business impact. SandboxAQ Academy (spun off from Alphabet in 2022) specializes in AI and quantum computing, featured in TIME’s Best Inventions 2024 and valued at $5.6 billion after raising $300M in 2025.

Skillsoft, a global leader serving organizations worldwide, offers AI Skill Accelerators, on-demand courses, interactive labs, and certifications through cloud-based blended learning.

Universities and MOOCs provide scalable credentials.

Coursera for Business offers 10,600+ courses from 350+ companies and universities, including AI for Business from Wharton and AI for Everyone from DeepLearning.AI’s Andrew Ng.

Udacity (now Accenture-owned) provides AI Nanodegree programs in Agentic AI, ML Engineering, and Deep Learning, developed with Google, Amazon, and Microsoft. Named to TIME’s Top EdTech Companies 2024, Udacity charges $399+/month for individual Nanodegrees with custom enterprise pricing. Johns Hopkins University offers a Certificate Program in Agentic AI covering rational agents, multi-agent systems, and the Model Context Protocol with real-world projects and professional mentorship.

The market is growing explosively:

the AI in corporate training market reached $1.5 billion in 2024 and is projected to hit $10.4 billion by 2033 at 25% CAGR.

The overall corporate training market is expected to reach $362 billion by 2025, with AI-related training representing 33% of all enterprise learning investments.

89% of businesses expect AI to transform their training programs, and 76% of HR leaders say they must adopt AI training within 12-24 months or fall behind competition.

Beyond ChatGPT: the enterprise AI tools that actually require training

AI development platforms for enterprises extend far beyond consumer chatbots. Anthropic’s Claude for Enterprise offers a 500K token context window (equivalent to hundreds of documents or medium-sized codebases) with GitHub integration, used by GitLab, Midjourney, and Novo Nordisk, which achieved a 90% reduction in documentation time.

Training is required for project management workflows, context window optimization, role-based permissions configuration, and specialized workflows for legal, financial, and coding applications.

Enterprise customers report 2-10x development velocity increases, with Claude Sonnet 4 achieving 72.7% success on SWE-bench coding tasks.

Cohere specializes in regulated industries (finance, healthcare, manufacturing, energy, public sector) with their North platform and Command A models for reasoning and tool use.

Their multilingual support spans 100+ languages, with partnerships including Oracle Fusion Cloud and SAP Business Suite integrations.

Training requirements include custom model deployment on-premises or private cloud, agentic AI workflow configuration, and security-first deployment strategies. AI21 Labs positions for enterprise with Jurassic-2 models, VPC and on-premises support, and focus on grounded, cited responses.

Co-founders claim they “usually win” when competing with OpenAI for enterprise business, requiring training on fine-tuning models with enterprise data and continuous pre-training with company terminology.

AI coding assistants are achieving massive adoption.

GitHub Copilot leads with 88% adoption among companies using AI coding tools per OpsLevel’s survey, but emerging competitors are disrupting satisfaction.

Cursor, an AI-native IDE, shows users becoming notably less satisfied with GitHub Copilot after adoption according to a16z’s survey of 100 CIOs. One CTO reports 90% of code now AI-generated through Cursor, up from 10-15% with Copilot.

This requires different training: Cursor uses a paradigm shift from traditional IDEs with agentic coding workflows, multi-model support (Claude, GPT-4), and sophisticated context management for large codebases. Amazon CodeWhisperer provides AWS-integrated solutions, while Tabnine and Codeium offer alternatives. Training investment is critical—teams with proper AI coding assistant training see 3x better adoption rates, with mandatory human-in-the-loop code review processes essential for security.

AI-powered automation platforms are converging with agentic AI.

UiPath, a Gartner Leader for RPA for seven consecutive years, is pivoting to agentic automation combining robots with AI agents.

Their Intelligent Document Processing (IDP) market grew from $1.05B (2021) to $1.85B (2023), with integration to Microsoft Copilot for Microsoft 365. Training requirements include transitioning from traditional RPA to agentic automation, understanding UiPath Autopilot™ conversational AI agent, building workflows with Agent Builder, and managing the AI Trust Layer.

Q3 2025 revenue reached $355M (9% YoY) with $1.607B ARR (17% YoY). Customer examples include Omega Healthcare (100% productivity increase), Canon ($18M saved, 900,000 hours), and Uber ($22M savings on pace).

Data science and ML platforms demand deep expertise.

DataRobot evolved from niche AutoML to full-lifecycle AI platform, now serving as SAP’s exclusive agentic AI partner with their agent workforce platform.

Training covers complex platform architecture spanning data prep, modeling, and ModelOps, plus agent building and orchestration. Rated 4.6 stars with 709 reviews on Gartner Peer Insights.

H2O.ai, with 20,000+ enterprise customers, requires high skill levels—even their Driverless AI GUI is designed for experienced data scientists.

Their 45 pre-designed applications include fraud detection, churn prediction, and anomaly detection.

Databricks combines data, analytics, and AI on their Unified Data Intelligence Platform with Agent Bricks for building AI agents on enterprise data, securing $100M deals with both OpenAI (GPT-5 integration) and Anthropic (Claude integration), used by Mastercard and major enterprises.

Enterprise search and knowledge management tools are transforming information retrieval.

Glean leads enterprise AI search valued at $7.2B (June 2025), up from $4.6B (September 2024), offering search across 100+ apps with Glean Chat reducing IT/HR requests by 20%.

Early customers achieve 93% adoption rates in just 2 years with ROI recovered in under 6 months, handling 100M+ agent actions per year across their platform. Named to Fast Company’s 2025 World’s Most Innovative Companies.

Training requirements include understanding semantic vs. lexical search, configuring connectors for enterprise apps, building custom AI agents, and managing permissions. Vector databases like Pinecone (leading managed solution) and Weaviate (open-source with 50,000+ AI builders) require training on vector embeddings, semantic search, implementing RAG architectures, and managing databases at scale.

Legal AI is achieving rapid enterprise adoption.

Harvey, valued at $3B (February 2025) up from $1.5B (July 2024), serves Allen & Overy (3,500+ lawyers, 40,000 queries during trial), PwC for tax/legal/HR (March 2023), and Ashurst as first generative AI for client work with 4,000+ lawyers.

97% of lawyers prefer Harvey’s custom case law model over GPT-4, requiring training on legal-specific AI workflows, complex reasoning across jurisdictions, integration with legal research databases, and ethical considerations.

Casetext’s CoCounsel (acquired by Thomson Reuters) reduced complaint response time from 16 hours to 3-4 minutes in AmLaw100 studies, with 79% of legal professionals adopting AI.

Customer service AI platforms achieve autonomous resolution at scale.

Intercom Fin resolves up to 83% of support inquiries with omnichannel support (tickets, email, live chat), used by Anthropic, Clay, Lightspeed, TravelPerk, and Coda, costing $0.99 per resolution on their pricing model. Zendesk AI integrates across their major platform with four pricing plans from Team ($55/agent/month) to Enterprise (custom), featuring AI chatbots, knowledge base powered responses, and drag-and-drop bot builders.

Ada resolves up to 83% of issues autonomously with multilingual support in 50+ languages using no-code chatbot builders.

Agent-building capabilities represent the next frontier

AI agents are positioned as the 2025 breakthrough technology, with 88% of executives planning to increase AI budgets specifically for agentic AI.

However, execution lags enthusiasm:

79% are adopting AI agents but only 11% have achieved full deployment, with most stuck in pilot phases.

The gap reveals critical training needs. McKinsey reports 78% of companies use Gen AI but 80% see no material earnings impact—the “Gen AI paradox.” AI agents solve this by automating complex end-to-end business workflows rather than just assisting with individual tasks.

Agent frameworks span open-source to enterprise platforms.

LangChain/LangGraph leads adoption with 1M+ developers, offering full-stack framework for LLM applications with LangGraph providing graph-based workflow design for complex multi-step agents.

Companies like Klarna reduced resolution time by 80% using LangChain.

LlamaIndex optimizes for document-heavy RAG workflows with industry-leading parsing via LlamaParse, handling 90+ unstructured file types including nested tables and complex layouts.

Salesforce’s Agentforce team leverages LlamaIndex extensively.

Microsoft’s AutoGen enables multi-agent collaboration with agents in diverse roles working on complex tasks, featured in DeepLearning.AI courses.

CrewAI provides role-based orchestration with agents as specialized “crew members.”

Microsoft Semantic Kernel focuses on enterprise mission-critical apps with formal planning abstraction.

OpenAI Agents SDK, the latest entrant (2024-2025), packages OpenAI capabilities for agents that reason, plan, and call functions.

Enterprise platforms offer low-code alternatives.

Salesforce Agentforce launched October 2024 as a “digital labor platform” with Agent Builder, Atlas Reasoning Engine, and pre-built agents for Service, SDR, and Campaign Management. 10,000+ agents were built at Dreamforce 2024, with Agentforce 2.0 (December 2024) adding Slack integration and enhanced reasoning. The Command Center provides agent observability and governance.

Microsoft Copilot Studio enables custom agents for M365 Copilot with graphical interfaces, now used by 100,000+ organizations (doubled in months per October 2024). Google Agent Builder integrates with Vertex AI, while AWS Bedrock Agents added multi-agent collaboration in December 2024.

Core technical capabilities require substantial training.

Agentic design patterns include ReAct (Reason + Act) for step-by-step thinking, tool use for calling external APIs and databases, planning for breaking complex goals into subtasks, reflection for self-evaluation and error correction, and multi-agent collaboration for coordinating specialized agents.

Workflow architectures span graph-based (LangGraph nodes for tasks, edges for control flow), event-driven (LlamaIndex Workflows for async orchestration), sequential vs. parallel execution strategies, and human-in-the-loop design with checkpoints.

Tool calling and function integration demands skills in defining function schemas and descriptions, enabling agents to call APIs and internal systems, tool selection and parameter passing, error handling when tools fail, RESTful API design and consumption, authentication and authorization, rate limiting and retry logic, and MuleSoft connectors for Salesforce ecosystems.

Enterprises report complex system integration, access control, and legacy system compatibility as the biggest barriers slowing adoption from 65% pilots to only 11% full deployment.

RAG for agents is more sophisticated than traditional RAG.

Vector databases require understanding embeddings and vector representations, with popular options including Pinecone, Weaviate, Qdrant, Chroma, and Milvus. RAG pipeline design encompasses document chunking strategies (optimal chunk sizes), embedding model selection, retrieval techniques (KNN, ANN), context window management, and reranking for improved relevance.

Agentic RAG extends beyond simple retrieval with multiple retrieval sources, dynamic query reformulation, multi-hop reasoning over documents, and self-correction based on retrieval quality.

Agent memory and state management involves multiple memory types: short-term (within-conversation context), long-term (persistent storage across sessions), semantic (facts and knowledge), and episodic (past interactions and outcomes).

Context window management now works with 100K-1M+ token windows, requiring context prioritization, pruning strategies, and handling the “lost in the middle” problem.

State management includes session persistence, checkpoint and resume capabilities, and conversational history tracking.

Multi-agent systems require orchestration expertise. Architectures include hierarchical (orchestrator + specialized workers), collaborative (peer-to-peer communication), sequential (task handoffs), and parallel (concurrent execution).

The Model Context Protocol (MCP) is emerging as a standard alongside Agent2Agent (A2A) protocols.

Coordination patterns involve task decomposition and allocation, conflict resolution, load balancing across agents, and preventing infinite loops and agent spam.

Agent evaluation and testing separates successful deployments from failures. Evaluation types include final response (did it achieve the goal?), trajectory (did it take the right path?), and component-wise (router, skills, memory effectiveness).

Key metrics track task completion rate, response accuracy (groundedness, relevance), convergence score (efficiency of steps), cost per interaction (token usage), latency/response time, and error rate.

Evaluation methods span code-based evaluators (deterministic checks), LLM-as-a-Judge (using another LLM to evaluate), human-in-the-loop assessment, A/B testing, and benchmark datasets like SWE-bench for coding agents (now achieving 60%+ scores).

Safety guardrails are mandatory for production.

Hallucination prevention requires RAG grounding to source documents, contextual grounding checks, provenance tracking (what source supports each claim?), and confidence scoring.

Content safety includes toxic content filtering, bias detection and mitigation, PII detection and redaction, and topic denial for off-topic discussions.

Security guardrails prevent prompt injection, detect jailbreak attempts, protect against data leakage, and enforce access control.

Implementation requires pre-input validation (before LLM), post-output validation (after LLM), real-time monitoring and intervention, and audit logging.

Tools include Guardrails AI (open-source), Amazon Bedrock Guardrails (filters 75%+ hallucinations), Azure AI Content Safety, Salesforce Trust Layer, and IBM’s Granite Guardian models.

Technical skills beyond basic prompting are essential.

Python is primary for virtually all frameworks, requiring async programming, API development (FastAPI, Flask), and object-oriented design for agent classes. JavaScript/TypeScript supports web integrations.

API design covers RESTful APIs and GraphQL.

Version control uses Git for agent development. DevOps establishes CI/CD pipelines for agent deployment.

Data and ML engineering includes vector database setup and querying, understanding embeddings, data engineering for ETL pipelines, prompt engineering (advanced techniques like Chain-of-Thought, few-shot, ReAct), and model selection for use cases.

Cloud and infrastructure span AWS, Azure, GCP deployment, Docker and Kubernetes for containers, Lambda and Azure Functions for serverless triggers, and monitoring for logging, tracing, and metrics.

Common enterprise use cases demonstrate practical applications.

Customer service achieves 70% autonomous resolution rates with ticket classification and routing, knowledge base Q&A with citations, order management and tracking, and returns processing.

Sales and marketing deploy SDR agents, lead qualification and scoring, email campaign generation, customer research and insights, and CRM data enrichment.

HR and employee services automate onboarding, benefits and policy Q&A, document generation (offer letters, contracts), leave management, and IT helpdesk functions. Development and engineering gains code generation and review, documentation automation, test case generation, legacy system modernization (50%+ time reduction reported), and bug triage.

Training programs are emerging rapidly.

Udemy’s “The Complete Agentic AI Engineering Course (2025)” runs 6 weeks covering OpenAI Agents SDK, CrewAI, LangGraph, AutoGen, and MCP with 8 real-world projects.

Coursera offers “IBM RAG and Agentic AI Professional Certificate” for program managers and technical professionals. Vanderbilt’s “Agentic AI and AI Agents: A Primer for Leaders” helps differentiate innovation from hype.

Udacity’s “Agentic AI Nanodegree” covers agentic workflows with prompt chaining, routing, and parallelization.

Johns Hopkins’ “Certificate Program in Agentic AI” includes rational agents, multi-agent systems, MCP protocol, game theory, ethics, and reinforcement learning.

DeepLearning.AI offers short courses including “AI Agentic Design Patterns with AutoGen” (creators Chi Wang and Qingyun Wu teaching reflection, tool use, planning, multi-agent collaboration) and “Evaluating AI Agents” (partnered with Arize AI covering observability, tracing, component-wise evaluation, LLM-as-a-Judge, and production monitoring).

Platform-specific training includes Microsoft Learn paths for Copilot Studio with free virtual workshops, Salesforce Agentforce Academy with Trailhead modules and Agentblazer status levels, and LangChain Academy with extensive documentation.

Gartner predicts 40% of enterprise applications will integrate task-specific AI agents by end of 2026 (up from <5% in 2025), 75% of enterprise software engineers will use AI code assistants by 2028 (up from <10% in 2023), and 15% of day-to-day work decisions will be made autonomously through agentic AI by 2028.

However, 40%+ of agentic AI projects will be canceled by end of 2027 due to escalating costs, unclear business value, or inadequate risk controls. The agentic AI market is projected at 45.8% CAGR from 2025-2030, reaching $41.32B by 2030.

ROI data reveals what works and what doesn’t in AI training

Productivity gains from AI usage are proven and substantial, but training program effectiveness data remains limited.

Nielsen Norman Group’s meta-analysis across three studies shows average productivity increases of 66%—customer support agents handle 13.8% more inquiries per hour, business professionals write 59% more documents per hour, and programmers complete 126% more projects per week.

Quality improvements reach 40% higher ratings for business documents. The Federal Reserve study (November 2024) found Gen AI users save 5.4% of work hours on average, translating to 2.2 hours saved weekly in a 40-hour work week.

Additional studies document impressive gains: consultants using AI complete 12.2% more tasks, 25.1% faster, with 40% higher quality according to Dell’Acqua et al. (2023).

AI navigation for taxi drivers reduced cruising time by 5.1% overall and 7.4% for lowest-skilled drivers. Critically, AI reduces skill gaps—lowest performers improved 35% in productivity versus top performers’ few percent improvement, suggesting democratization of expertise.

The training-to-ROI gap is enormous.

While 78% of organizations use AI in at least one business function (up from 55% in 2023), only 1% describe rollouts as “mature” with full workflow integration. IBM’s December 2024 study shows 47% achieving positive ROI from AI projects, with 33% breaking even and 14% negative ROI.

However, 92% expect positive ROI within 3 years. Among those not yet seeing returns, 44% expect results within 1-2 years.

The critical 6% statistic reveals the core problem: BCG found 89% of executives acknowledge their workforce needs improved AI skills, but only 6% have begun upskilling “in a meaningful way.”

This represents the most critical gap in AI adoption—the bottleneck isn’t technology but organizational commitment to training at scale.

Training completion rates vary dramatically by delivery method. Self-paced online courses achieve only 5-15% completion rates, while MOOCs average 3-6%.

In stark contrast, cohort-based programs reach up to 85% completion rates—a 10-17x improvement. Key success factors include structure, interaction, and accountability that self-paced programs lack. TalentLMS’s 2024-2025 benchmark report found 49% of employees say AI is advancing faster than company training programs, 65% want training on safe and ethical AI use, yet 63% say training programs could be improved.

Alarmingly, 37% of Gen Z will look for a new job in 2025 if training is inadequate.

Time-to-competency shows AI’s dual effect.

Customer support agents with AI reached expert performance in 2 months versus 8 months without AI—4x faster skill acquisition.

Studies show immediate productivity gains with expectations of larger gains after repeated use due to learning curves. This suggests training should emphasize hands-on practice over extended lecture-based learning.

Documented ROI case studies provide concrete benchmarks.

Vizient (healthcare) achieved 4x estimated ROI with ~$700,000 saved in first year using AI, attributing success to identifying AI champions across departments.

Qualcomm rolled out to hundreds of users across departments with 70 defined workflows and 25+ use cases, saving 2,400 hours monthly across all users.

Jaguar Land Rover’s Multiverse program upskilled 600 employees in data, with learners identifying cost reduction and revenue increase opportunities.

Government health agencies report 40% reduction in training time using AI-driven personalized platforms, with organizations using AI for training seeing 40% cost reductions and 50% decreased training time.

McKinsey’s long-term opportunity quantification positions AI training as gateway to $4.4 trillion in added productivity potential.

Currently, 92% of companies plan to increase AI investments over next 3 years, 87% expect revenue growth from gen AI within 3 years, and 51% expect revenue boosts of 5%+ in next 3 years. Yet only 19% currently report 5%+ revenue increases and 36% report no change—illustrating the expectation-reality gap that training must bridge.

PwC’s research shows companies report 20-30% gains in productivity, speed to market, and revenue from incremental AI value, with 49% of tech leaders saying AI is fully integrated into core business strategy and 1/3 saying AI is fully integrated into products and services.

Forrester’s State of AI Survey reveals 2/3 of organizations would consider AI investments successful with less than 50% ROI—relatively low expectations compared to traditional tech investments, suggesting patience for learning curves.

Training method effectiveness shows clear patterns.

Most effective approaches include hands-on/on-the-job training where employees improve knowledge by using AI applications while doing jobs;

cohort-based programs with 85% completion rates versus 5-15% for self-paced; role-specific training tailored for job functions (technical teams get bootcamps on library creation, functional teams get prompt engineering classes);

AI champions programs (77% of employees using AI see themselves as potential champions, with WRITER users 2x more likely to become champions, enabling peer-to-peer knowledge sharing); and personalized/adaptive learning with AI-driven approaches showing 30% increases in employee engagement and 25% improvements in learning outcomes per McKinsey, with medical training using AI simulations achieving 95% retention rates per the American Medical Association.

Strategic planning separates success from failure.

Companies WITH formal AI strategy achieve 80% success rate; companies WITHOUT AI strategy achieve 37% success rate—a 43-percentage-point gap.

Investment level creates a 40-percentage-point gap in success rates between highest and lowest investors. Organizational alignment matters critically:

68% of executives report tension between IT and other departments, 72% observe AI applications developed in silos, and cross-functional collaboration is essential.

Training delivery matters too: 89% of workers would feel encouraged with tailored, role-specific training, and 63% prefer training delivered at point of need, suggesting just-in-time microlearning outperforms lengthy sessions.

What companies actually measure reveals priorities.

IBM’s December 2024 study found top ROI metrics are faster software development (25%), more rapid innovation (23%), productivity time savings (22%), and hard dollar/quantifiable savings (15%—distant 4th).

Common measurement frameworks include hard ROI metrics (labor cost reductions, revenue increases per department, cost savings from efficiency, time-to-completion reductions, error rate decreases) and soft ROI metrics (employee satisfaction and retention, improved decision-making speed/accuracy, customer satisfaction NPS increases, innovation outcomes, skills assessment score improvements).

Critical gaps in ROI measurement reveal what’s unknown. Limited training-specific ROI data exists—most productivity studies measure AI tool usage, NOT training program effectiveness.

Isolating training ROI from general AI adoption ROI proves difficult. Long-term impact remains unknown, with most studies lasting months rather than years and longitudinal training effectiveness data extremely limited.

Lack of standardized metrics plagues the field, with no industry-standard framework for measuring AI training ROI and companies using inconsistent metrics that prevent comparisons. Only 39% of C-suite leaders use benchmarks to evaluate AI systems. Training completion rates for enterprise AI programs aren’t widely published, with general online learning rates (5-15%) available but not AI-specific.

Skills assessment data showing before/after improvements is rarely published, and retention impact linking AI training to employee retention rates is limited despite general L&D correlations (27% cite L&D as top reason to choose job, 25% to stay).

Employee resistance creates ROI barriers.

Top barriers include skills gaps (46% of leaders cite as #1), limited resources (38%), and organizational challenges where only 34% are currently training/reskilling employees (IBM 2023), 54% of companies lack guidelines on using AI tools (TalentLMS), and 11% outright forbid AI tool use. 41% of Millennial/Gen Z employees admit to sabotaging company AI strategy, 35% pay out-of-pocket for AI tools when employer tools are inadequate, and 25% worry jobs will become obsolete due to AI (up from 15% in 2021).

The correlation between training and adoption is strong.

Training ranks as the top adoption driver, with 48% of employees citing formal training as the #1 factor to increase daily AI use, followed by seamless workflow integration (45%), tool access (41%), and incentives (40%). Support level dramatically impacts outcomes: international employees with 84% adequate support still want more training, while U.S. employees with only ~50% adequate support cite this as a major barrier.

Manager roles prove critical—68% of managers field AI questions from teams at least weekly, and 86% of AI tools recommended by managers successfully resolve challenges. Generational differences reveal millennials (35-44) show 62% high expertise as natural change champions, Gen Z (18-24) shows 50% high expertise, and baby boomers (65+) show only 22% high expertise.

Employee retention impact from training shows general L&D has proven effects: 27% of workers cite “excellent L&D opportunities” as top 5 reasons to choose new job, 25% say L&D would make them stay in current role, and 67% would stay even if they hated their role if it granted quick upskilling opportunities.

AI-specific concerns intensify pressure: 70% feel L&D could be improved, 44% of 18-34 year-olds are considering leaving due to insufficient L&D, and 37% of Gen Z specifically cite AI training gaps as reason to leave in 2025.

Small companies need fundamentally different training approaches

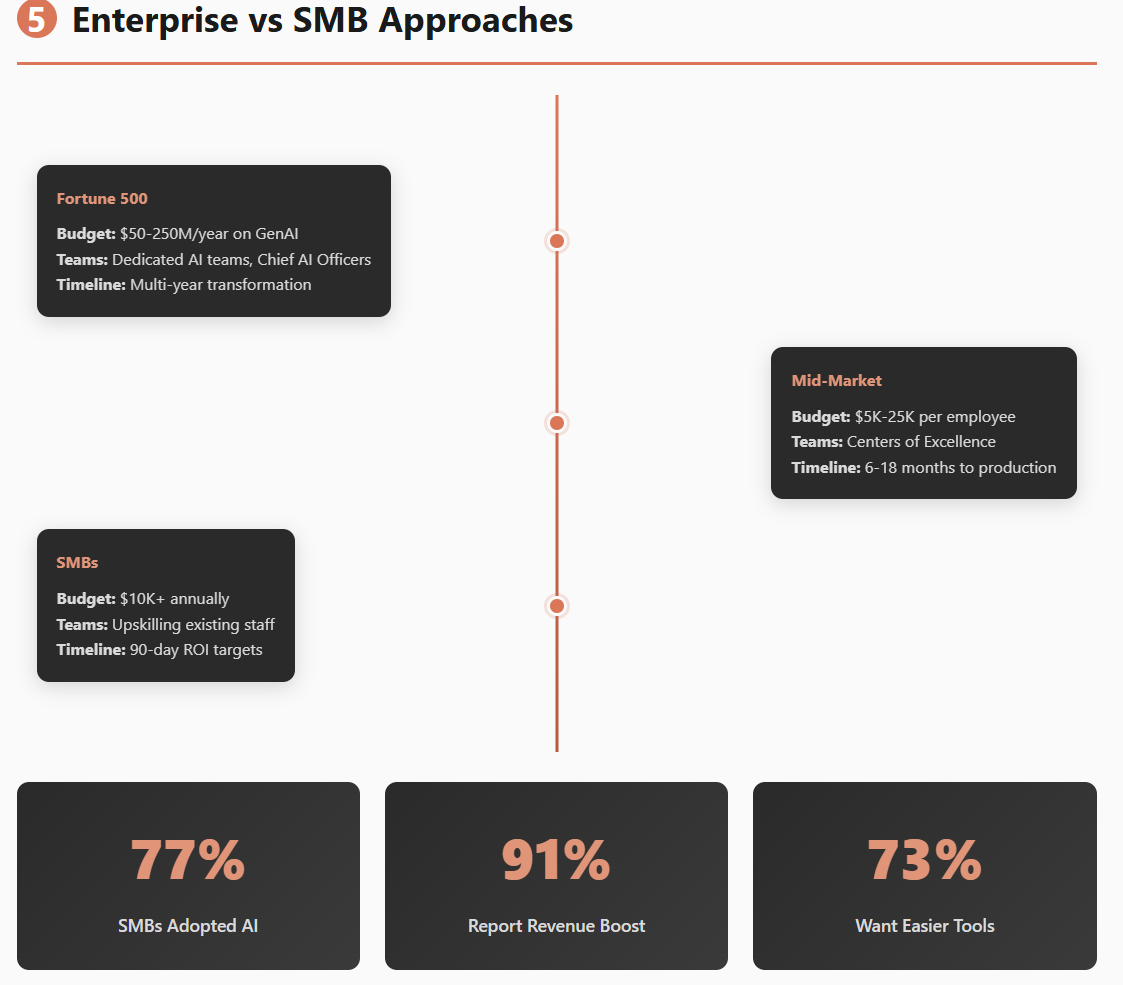

SMB AI adoption has exploded but remains distinct from enterprise patterns. 77% of SMBs have adopted AI in some capacity (Service Direct, 2024), with 75% experimenting or using AI (Salesforce, 2024).

91% of SMBs using AI report revenue boosts. SMB adoption more than doubled from 14% (2023) to 39% (2024) in the U.S., with businesses having 10-100 employees reaching 68% usage in 2025.

This rapid acceleration contrasts with enterprise adoption: over 90% of Fortune 500 companies use OpenAI’s technology, 42% have deployed AI with another 40% piloting, and in the EU, 41.2% of large enterprises used AI versus only 11.2% of small firms in 2024.

Budget constraints create fundamentally different strategies. Over 50% of SMBs spend more than $10,000 annually on AI—modest compared to enterprise scale but significant for small business operating budgets. Businesses with <$5,000 budgets face foundational challenges (integration 30%, keeping up with advances 29%). Businesses with $5,000-$25,000 budgets struggle with data quality issues (49%) and training needs (44%).

However, investment is accelerating: 58% of businesses with <10 employees plan to increase AI budgets by $5,000+ in next 12-24 months, 67% of 10-50 employee businesses plan $5,000+ increases, and 77% of 50+ employee businesses plan similar increases.

SMBs primarily use operating revenue rather than formal IT budgets, focusing intensely on measurable ROI—74% need clearer ROI evidence to adopt.

Enterprise budgets operate at entirely different scale. Enterprise LLM budgets are growing 75% year-over-year (2025 projection), with one CIO noting: “What I spent in 2023, I now spend in a week.”

Innovation budgets dropped from 25% to just 7% of AI spending as AI moves from experimental to centralized IT and business unit budgets. AI now represents 12% of IT budgets (up from 10%), with financial services accounting for 20%+ of all AI spending.

Average organizations identify 10 potential AI use cases with 24% prioritized for near-term implementation, and 92% of executives expect to boost AI spending in next 3 years.

Staffing differences drive distinct training needs. SMBs lack dedicated AI teams, with 62% citing lack of understanding about AI benefits as top barrier, 60% reporting insufficient in-house resources, 71% lacking AI understanding despite using tools, 31% of SMB leaders not knowing enough about AI, and 13% lacking properly trained employees. Only 33% of SMB AI users have received proper training (Microsoft).

SMBs cope by upskilling existing employees rather than hiring specialists, with 57% considering AI talent “quite strong” after training. More than half of participating SMBs have conducted AI training, with increasing reliance on managed service providers and consultants.

They prefer embedded AI in existing tools (Microsoft 365, Google Workspace).

Fortune 500 enterprises have Chief AI Officers and Chief Data Officers as standard, with dedicated teams of AI/ML engineers, data scientists, and AI integration specialists.

Yet they still face challenges:

46% cite talent skill gaps as reason for slow development, 38% face resourcing constraints, and they need to attract top-tier talent with cutting-edge tools and collaborative culture.

Nearly half of employees want more formal training, with 84% of international employees receiving significant organizational support versus 52% in U.S. Training is tailored by role: technical bootcamps for engineers, prompt engineering for functional teams. 68% of managers recommend gen AI tools monthly with 86% success rate when managers make recommendations.

Training format preferences reflect complexity tolerance. SMBs want AI embedded in existing applications—73% want easier-to-use AI tools.

“For most SMBs, the easiest way to use AI is as part of applications you already use every day” (SMB Group).

They prefer no-code/low-code platforms and SaaS-based solutions over custom development, with practical training ranked as top support need.

Popular tools include ChatGPT (simple, consumer-friendly interface), Microsoft 365 Copilot (integrated into workflows), Google Workspace AI/Gemini, Adobe Creative Cloud (automatic AI capabilities), and Salesforce Starter/Agentforce. Training approaches favor vendor-led webinars and tutorials, self-paced learning modules, peer learning and experimentation, starting with 1-2 high-impact use cases, and implementation partners for simple guardrails.

Fortune 500 enterprises prefer enterprise-wide AI strategy development, Center of Excellence creation, executive briefings for C-suite alignment, role-specific bootcamps (technical vs. functional), formal AI governance frameworks, and multi-phase implementation roadmaps. Consulting requirements include strategic partnerships with IBM Consulting (75K+ trained consultants), dedicated AI consulting services from major firms, platform implementation specialists, change management consultants, and security and compliance advisors.

Training approaches emphasize upskilling bootcamps for technical teams, prompt engineering classes for functional teams, beta testing and pilot programs, AI literacy programs across organizations, and continuous learning via internal AI academies.

Implementation speed requirements differ dramatically. SMBs expect 90-day targets for first revenue-generating use case with “weeks instead of months” versus enterprise sales cycles. 71% plan to increase AI investment over next year, with 78% of growing SMBs increasing investment versus 55% of declining peers.

Speed drivers include competitive pressure (66% believe AI essential for staying competitive), immediate productivity gains (87% report increased productivity), customer-facing use cases prioritized (marketing 53%, sales 49%, support 46%), and need to show tangible results quickly to justify continued investment. Implementation approaches start small and expand gradually, testing with single high-impact tools (chatbot, marketing automation), taking incremental steps with external expertise, and using phased approaches to build confidence.

Fortune 500 enterprises work on multi-year transformation roadmaps where pilot to production can take 6-18 months, emphasizing strategic deployment over experimentation.

Only 1% believe they’re at AI maturity despite widespread investment. Speed challenges include talent skill gaps (46%), resourcing constraints (38%), complex approval processes (8%), technical complexity (8%), and need for leadership alignment across multiple domains. Implementation approaches follow rewired frameworks: roadmap, talent, operating model, technology, data, and scaling. They establish Centers of Excellence to coordinate efforts, use cross-functional agile teams, adopt modern cloud practices with multidisciplinary collaboration, and focus on sustainable long-term transformation.

Use case priorities reveal strategic differences. SMBs prioritize customer-facing, revenue-generating applications: marketing (53%)—campaign optimization, content generation, lead scoring; sales (49%)—automated emails, lead qualification; customer support (46%)—chatbots, automated responses; data analysis (62% of daily users); and content generation (55% of daily users).

77% prioritize marketing and customer engagement, 84% willing to automate marketing content creation, and 59% would automate customer service inquiries.

ROI metrics show 91% report revenue boost, 87% increased productivity, 86% improved effectiveness and margins, and 90% say AI makes operations more efficient.

Fortune 500 enterprises focus on IT automation, security, and scale: software development with step-change adoption (90% code AI-generated in some cases); IT process automation (33% in production); security/threat detection (26%); enterprise search and data analysis; and customer support (90%+ testing third-party apps). Multi-function adoption is common—50% use AI in 2+ functions, up from 30%.

Strategic priorities include scaling operations (not just efficiency gains), risk management and compliance, competitive differentiation through custom solutions, and business model transformation (not just process improvement).

81% of Fortune 500 executives believe AI will reshape industries in 5 years.

Vendor strategies must reflect segment differences.

For SMBs: embedded AI-as-a-Service model, vertical-specific solutions with clear ROI, simplified transparent pricing, self-serve onboarding with support safety net, channel partner enablement (MSPs as advisors), consumer brand awareness driving enterprise adoption, and “prosumer” products that scale to business use.

For enterprises: AI-native architecture (not retrofitted), fast innovation cycles (outpace incumbents), use case specialization (coding, security, etc.), enterprise-grade security and compliance, strategic consulting services, custom implementation support, direct model access (not just through clouds), and external validation (benchmarks, case studies).

The fundamental philosophical difference:

A 50-person company views AI as “a productivity tool to help me compete” while a 50,000-person company sees AI as “strategic infrastructure for transformation.”

This shapes everything:

Decision-making (1-2 decision-makers taking weeks versus multiple stakeholders taking months with formal governance), implementation (buy off-the-shelf and embed in workflows versus build custom and integrate across systems), success metrics (hours saved, revenue influenced, leads generated versus cost to serve, cycle time reduction, strategic positioning), skills development (upskill existing staff, learn by doing versus hire specialists, formal training programs), vendor relationships (transactional SaaS subscriptions with MSP support versus strategic partnerships with custom contracts and dedicated teams), and innovation pace (fast follower adopting proven solutions versus bleeding edge in select areas but slower overall).

Concrete recommendations for different enterprise segments

For Fortune 500 companies with dedicated AI teams,

prioritize building Centers of Excellence that coordinate across business units while maintaining agility.

Invest heavily in multi-track training: technical bootcamps teaching LangChain/LangGraph, RAG systems, and agentic workflows for engineering teams; prompt engineering and AI literacy programs for functional teams; and executive education on AI strategy and governance for leadership.

Implement formal evaluation frameworks using tools like LangSmith, Arize AI, or Azure AI Foundry to measure agent performance systematically.

Establish AI champion networks—employees using AI tools are 2x more likely to become champions who drive peer adoption. Partner strategically with vendors like Anthropic Claude for coding, OpenAI for general reasoning, and Google Gemini for cost-effective scale, while maintaining multi-model strategies (37% of enterprises now use 5+ models).

For mid-sized companies ($50M-$500M revenue) building AI capabilities,

focus on role-specific training pathways rather than one-size-fits-all approaches—Moderna’s experience proves universal training fails across diverse job functions. Start with high-impact, customer-facing use cases in marketing, sales, or customer support where ROI is measurable within 90 days.

Leverage enterprise platforms like Salesforce Agentforce or Microsoft Copilot Studio that provide low-code agent building to reduce technical barriers. Partner with implementation consultants for the first 2-3 projects to transfer knowledge while building internal expertise.

Budget $5,000-$25,000 per employee for comprehensive training over 12 months, recognizing that inadequate training is the #1 reason talent leaves (37% of Gen Z will quit without proper upskilling).

For small businesses (<50 employees) without AI teams,

Embed AI training into existing tools rather than teaching standalone platforms—73% of SMBs want easier-to-use AI tools integrated into daily applications.

Start with Microsoft 365 Copilot, Google Workspace AI, or ChatGPT Enterprise for immediate productivity gains, requiring only prompt engineering skills.

Invest in cohort-based training that achieves 85% completion rates versus 5-15% for self-paced courses—accountability and peer learning drive results.

Focus training on 1-2 high-impact use cases: marketing automation (53% of SMBs prioritize this), sales email automation (49%), or customer support chatbots (46%). Partner with managed service providers who can act as fractional AI teams, providing implementation support and ongoing training. Budget for $5,000-$10,000 initial AI investment with plans to increase by similar amounts annually as capabilities mature.

For AI training vendors and consultants,

Differentiate by segment with clear positioning.

For SMBs: create vertical-specific solutions (healthcare, legal, retail) with proven ROI metrics, offer transparent pricing without hidden costs, provide embedded training within the product (not separate courses), enable 30-day proof-of-value pilots, and partner with MSPs for local trusted advisor relationships.

For enterprises: develop industry-specific frameworks (financial services, pharmaceuticals, manufacturing), provide white-glove implementation with dedicated customer success managers, offer custom integrations with existing tech stacks, include executive briefings and change management consulting, demonstrate ROI through rigorous evaluation frameworks, and maintain strategic partnerships with major cloud providers (AWS, Azure, GCP).

For all segments, recognize that companies with formal AI strategy achieve 80% success rates versus 37% without—strategy isn’t optional. Implement cohort-based training over self-paced (85% vs 5-15% completion), deliver training at point of need rather than front-loading lengthy courses, identify and empower AI champions (77% of AI users can become champions), measure what matters (task completion rates, time savings, quality improvements, not just usage statistics), establish guardrails mandatory for production (hallucination prevention, content safety, security controls), and plan for continuous learning infrastructure—when 78% of executives say AI advances faster than training can keep pace, one-time training events become obsolete immediately.

The fundamental insight across all segments: the $4.4 trillion productivity opportunity isn’t blocked by AI technology limitations—it’s blocked by the massive gap between 89% of companies acknowledging skill needs and only 6% meaningfully upskilling their workforce.

The winners will be organizations that treat AI training as strategic infrastructure requiring sustained investment, not optional enrichment programs. For Fortune 500 companies like KPMG, this means multi-year transformation programs with dedicated budgets and executive sponsorship.

For smaller companies without AI teams, it means embedded learning in existing tools with external expert partnerships.

But for all enterprises, the timeline is urgent: with 37% of Gen Z ready to leave over inadequate training and skills changing 66% faster in AI-exposed jobs, the cost of inaction far exceeds the investment in comprehensive training programs

.